Why Premium Increases are Needed

Two key factors considered when assessing premium adequacy are 1) investment returns and 2) claims experience (morbidity and mortality patterns and lapse rates).

Investments

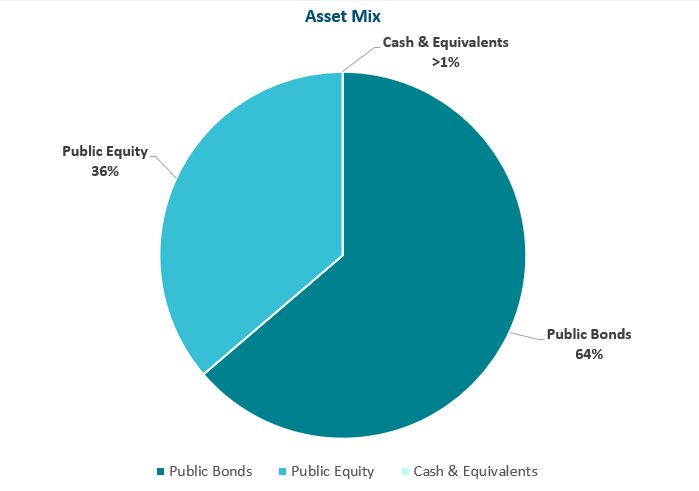

The FLTCIP's current investment strategy has two tracks: 1) the matching track, which aims to address shorter term liabilities (within the next 20 years) and only invests in bonds, and 2) the target track, which aims to meet liabilities that are 20 or more years out and invests in a mix of bonds and equities.

Bonds are investment securities where an investor lends money to a company or government for a set period of time, in exchange for regular interest payments. Once a bond reaches maturity, the bond issuer returns the investor's money.

Bonds are the staple of many long term care insurance (LTCI) investment portfolios, including the FLTCIP. The majority of the FLTCIP's funds are invested in a mix of different bond types, which are widely available and reliable.

When these bonds mature, the proceeds are used to either pay current claims or reinvested to pay future claims. If the interest rates payable for new bonds have dropped, then the new funds are reinvested at lower yields. This is one of the main factors that has led to LTCI premium increases throughout the industry.

Equities or stocks are shares in a company. If an investor buys equities, it means they have an equity interest or ownership of shares of stock in the company.

The FLTCIP's investment strategy also includes equities which are expected to generate higher returns over longer periods of time despite their potential for short-term volatility.

This figure is as of December 31, 2022 and represents the FLTCIP's asset mix in the fourth quarter of the 2022 calendar year.

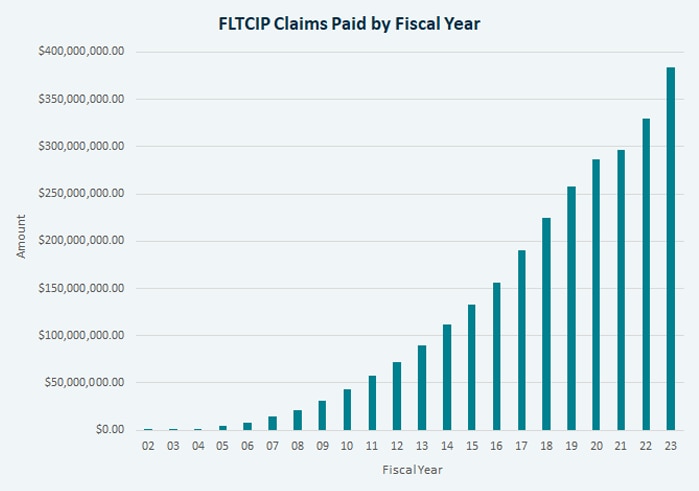

Claims Experience

Morbidity collectively refers to the following terms:

- Incidence: The rate at which enrollees start to experience illnesses that weaken them and cause them to become dependent on others to perform activities of daily living (like eating, dressing, and bathing) or cognitive impairments (like Alzheimer's disease) that make it difficult for them to live independently.

- Claim termination: The rate at which a claim is terminated because the enrollee recovers or dies.

- Utilization: The percentage of the benefit pool that will be used.

Conditions such as cognitive impairments tend to last longer and evolve over many years. The higher costs associated with these longer-term claims can increase projected claims costs.

Active life mortality is the rate at which enrollees die while actively living, without needing long term care. The FLTCIP active life mortality rates have generally been improving. This is good news but increasing life expectancy can lead to an increased likelihood of people needing care, which can also increase projected claims costs.

A lapse is the cancellation of coverage. Lapse rates are an important consideration when pricing LTCI. When an enrollee lapses coverage, the premiums paid by that enrollee remain with the program.

Changes to morbidity and mortality rates are not unique to the FLTCIP and have broad economic impacts beyond the FLTCIP and the LTCI industry. In 2010, U.S. spending on long term care services was about 1% of gross domestic product, but by 2050 that is expected to grow to 3%. 1

This figure is as of September 30, 2023, the end of the 2023 fiscal year.

Future Projections

LTCI projections are not only for liabilities that are expected in the near term. They include assumptions about what is going to happen for many years into the future. While many claims may be decades away, any negative trends in investment and claims experience can compound over time which may lead to a large gap if left unaddressed. For this reason, corrective action may be needed from time to time to ensure premiums reflect the cost of the benefits. The same commitment must be met for new enrollees and all future claimants, just as it is now for the more than 7,200 enrollees currently receiving benefits (as of December 2023).

When a Premium Increase Happens

The decision to increase premiums for enrollees is one that is taken seriously and only after extensive analysis.

Here are some important things to consider:

- Any premium increase is solely to help ensure that the FLTCIP premiums reflect the cost of the benefits provided.*

- If a premium increase is requested by the insurance carrier, the proposed premiums are reviewed by OPM.

- The risk fees that are contractually payable to John Hancock to manage investments are set by formula, capped and subject to performance metrics.

- Your premium will not change because you get older or your health changes or for any other reason related solely to you.

- Enrollees are not subject to a rate increase while they are eligible for benefits.

- Enrollees subject to a premium rate increase may be provided with options to reduce benefits to help mitigate the premium increase.

- Some enrollees subject to a premium rate increase may be eligible to convert their coverage to paid-up coverage, generally equal to the total amount of premiums paid less any previous benefits received under their plan.